DecisionPoint July 25, 2022 at 05:39 PM

On this week's edition of The DecisionPoint Trading Room, Carl and Erin cover the indicators and live market action. Erin takes a deep dive into the Energy sector, among others that appear promising... Read More

DecisionPoint July 18, 2022 at 06:07 PM

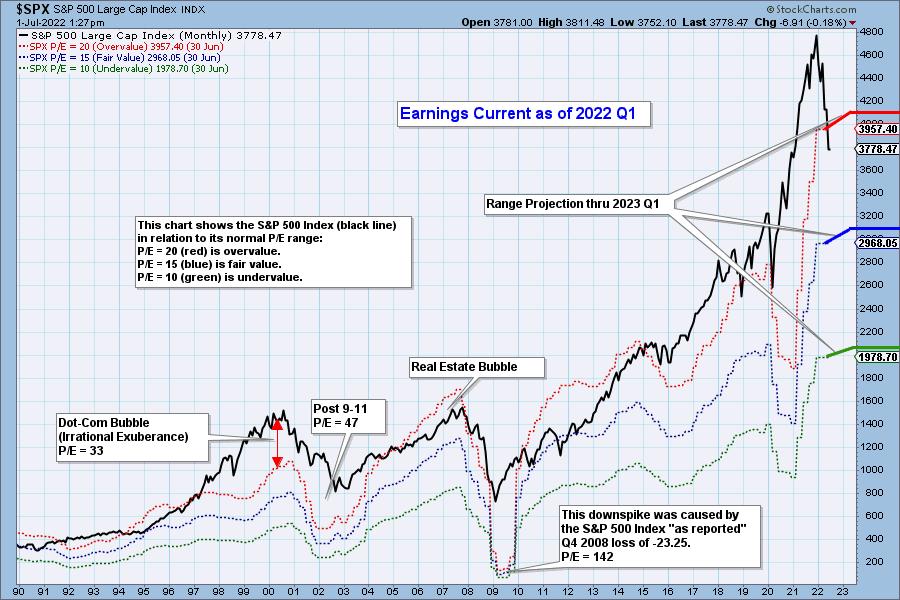

On this week's edition of The DecisionPoint Trading Room, Carl opens the session with his market overview, spending extra time on Crude Oil. He answers quite a few viewer questions, including a discussion of his famous P/E chart, and elaborates on questions regarding Energy... Read More

DecisionPoint July 15, 2022 at 08:47 PM

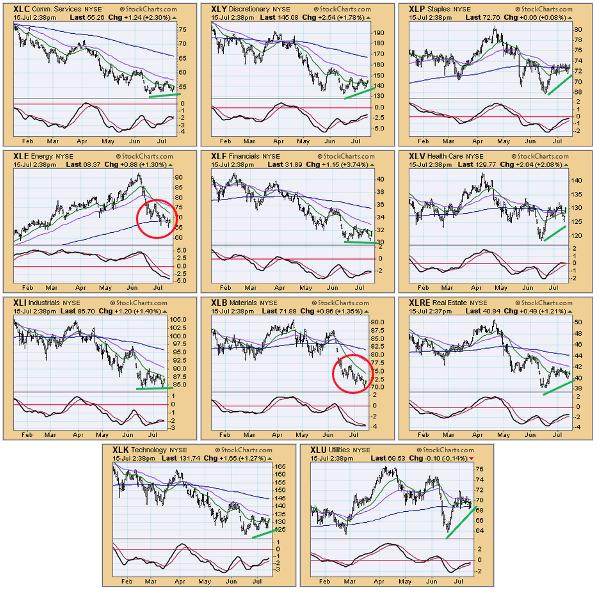

While we have negative long-term expectations for the market, we notice that most of the eleven S&P sectors are looking rather bullish intermediate-term... Read More

DecisionPoint July 11, 2022 at 05:17 PM

Carl and Erin present the premiere of StockCharts TV's new series, The DecisionPoint Trading Room! Carl takes questions on options, his favorite indicators and market trend following. Erin deep dives into Technology, Healthcare and Real Estate, plus covers symbol requests... Read More

DecisionPoint July 01, 2022 at 02:05 PM

The following chart shows us the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E of 20 (red line), a fairly valued P/E of 15 (blue line), or an undervalued P/E of 10 (green line)... Read More