Market Recap for Monday, May 20, 2019

Monday marked another rough May trading day, especially for the NASDAQ, which dropped 1.46%. The other major indices fell, but to a much lesser extent. Technology (XLK, -1.74%) and communication services (XLC, -1.65%) were hardest hit as weakness in semiconductors ($DJUSSC, -3.89%) and internet ($DJUSNS, -1.69%) took a toll on their respective sectors. The DJUSSC could have hit an important support level, however, and is featured below in the Sector/Industry Watch section.

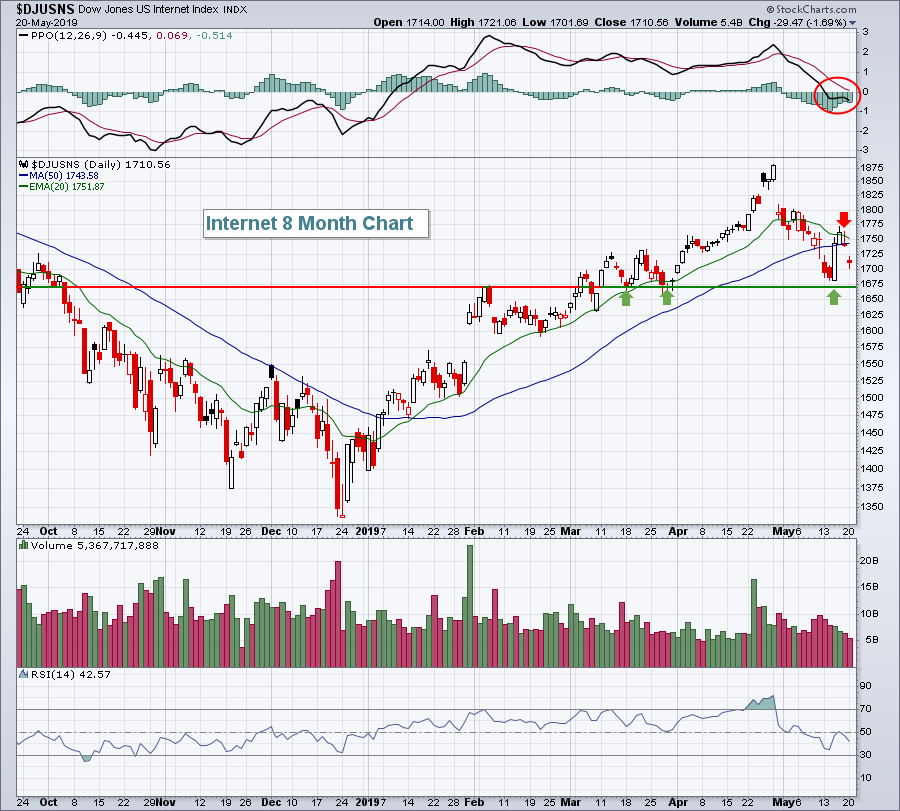

The DJUSNS has been faltering beneath its 20 day EMA and has some work to do technically to repair the damage:

Thus far, the price support level near 1670 has held beautifully and needs to continue to do so. Failure there could result in another 3-4% downside closer to 1600 where we saw buyers return twice in February.

Thus far, the price support level near 1670 has held beautifully and needs to continue to do so. Failure there could result in another 3-4% downside closer to 1600 where we saw buyers return twice in February.

A few sectors did manage to end yesterday's selloff in positive territory, most notably the defensive utilities (XLU, +0.14%). Financials (XLF, +0.11%) were relieved to see the 10 year treasury yield ($TNX) gain 2 basis points to 2.42%, its highest close in four days. Life insurance ($DJUSIL, +0.34%) and banks ($DJUSBK, +0.23%) benefited from the bounce in yields.

Mobile telecommunications ($DJUSWC, +2.01%) got a big lift from the FCC head saying that he was in favor of the $26 billion acquisition of Sprint (S, +18.77%) by T-Mobile (TMUS, +3.87%). The DJUSWC is in a very bullish long-term ascending triangle pattern, the breakout of which would likely launch most stocks in the group higher:

That's a very well-defined pattern that most traders will see. Therefore, a breakout carries even more weight in my opinion.

That's a very well-defined pattern that most traders will see. Therefore, a breakout carries even more weight in my opinion.

Pre-Market Action

Asia was mixed overnight with the Shanghai Composite ($SSEC, +1.23%) gaining ground. European shares are rebounding this morning, led by the German DAX ($DAX), which is up nearly 1%.

Dow Jones futures are up 115 points with a little more than an hour to the opening bell.

AutoZone (AZN) is seeing a nice pop after its quarterly earnings were released this morning, but the same cannot be said for Kohls (KSS), which is tumbling nearly 10% after disappointing the Street.

Current Outlook

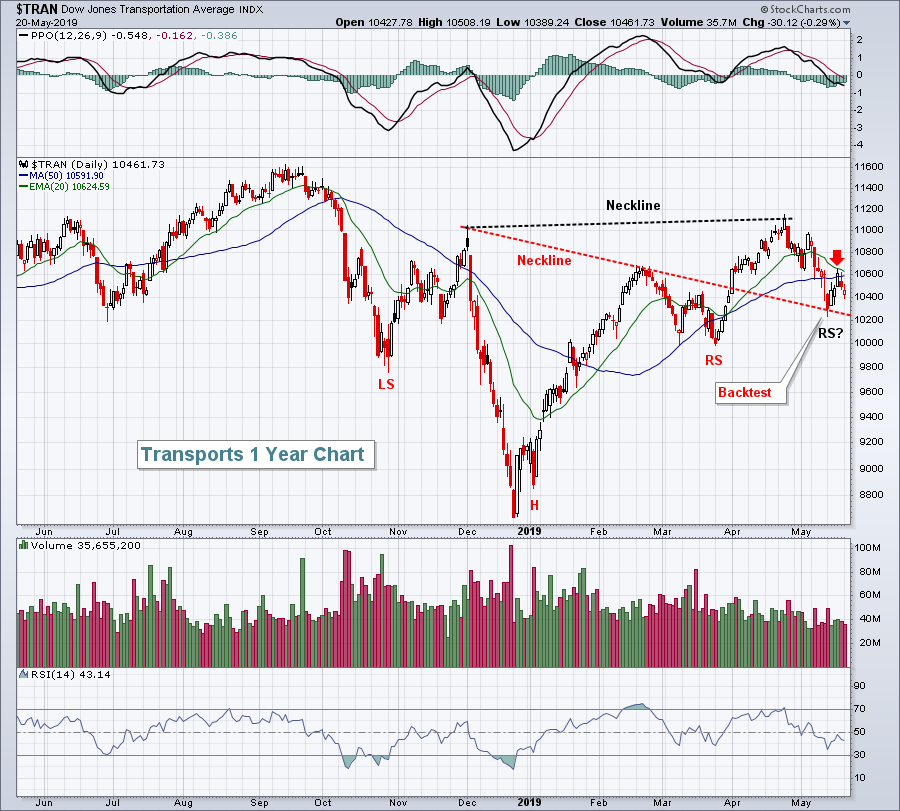

Let's look at transportation stocks ($TRAN) - the long- and short-term. First, let's review the short-term daily chart:

There are a couple of possible reverse head & shoulders patterns here - one depicted with a red dotted neckline and the other with black. Maybe neither will result in bullish action down the road, but it will be important to watch the now-declining 20 day EMA (red arrow). As long as the TRAN is downtrending beneath its 20 day EMA with a PPO in negative territory, I'd be short-term cautious.

There are a couple of possible reverse head & shoulders patterns here - one depicted with a red dotted neckline and the other with black. Maybe neither will result in bullish action down the road, but it will be important to watch the now-declining 20 day EMA (red arrow). As long as the TRAN is downtrending beneath its 20 day EMA with a PPO in negative territory, I'd be short-term cautious.

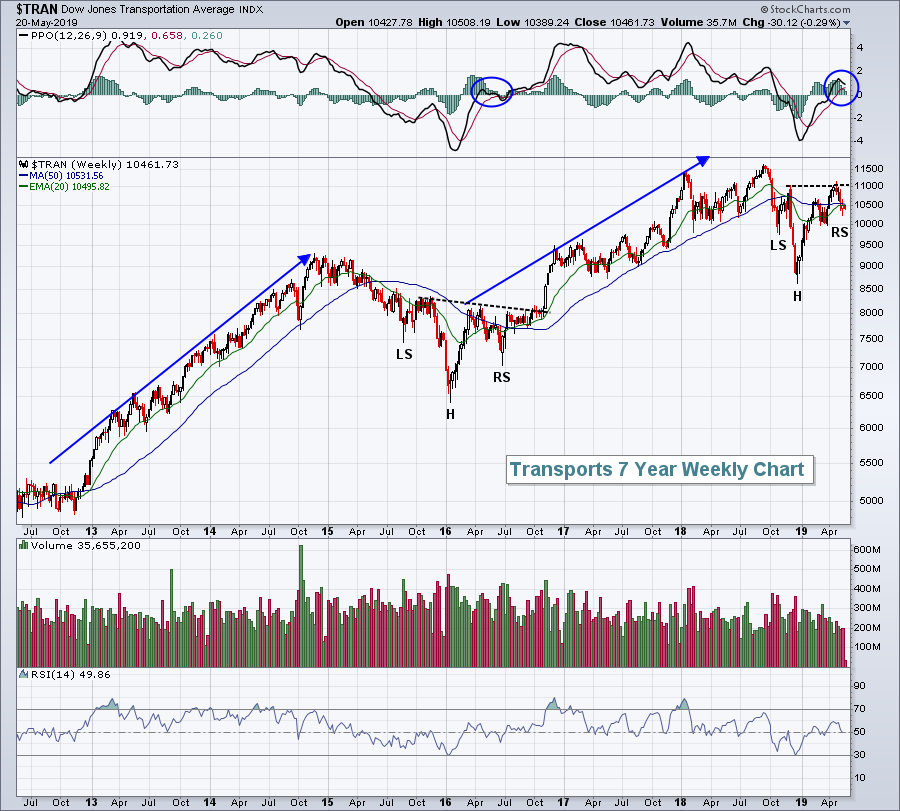

Longer-term, I'm much more bullish:

Rallies do not last forever. Basing, or consolidation, periods are beneficial as they allow the PPO to reset at centerline support - at a minimum. Those periods can be very frustrating as the overall market moves higher and transports don't participate, but catching the uptrends is what you want to do. I'm waiting patiently here, but on a definitive breakout above 11000, you might consider adding truckers ($DJUSTK) to an already hot railroad group ($DJUSRR).

Rallies do not last forever. Basing, or consolidation, periods are beneficial as they allow the PPO to reset at centerline support - at a minimum. Those periods can be very frustrating as the overall market moves higher and transports don't participate, but catching the uptrends is what you want to do. I'm waiting patiently here, but on a definitive breakout above 11000, you might consider adding truckers ($DJUSTK) to an already hot railroad group ($DJUSRR).

The DJUSTK could be printing its very own reverse right shoulder currently on a longer-term weekly chart.

Sector/Industry Watch

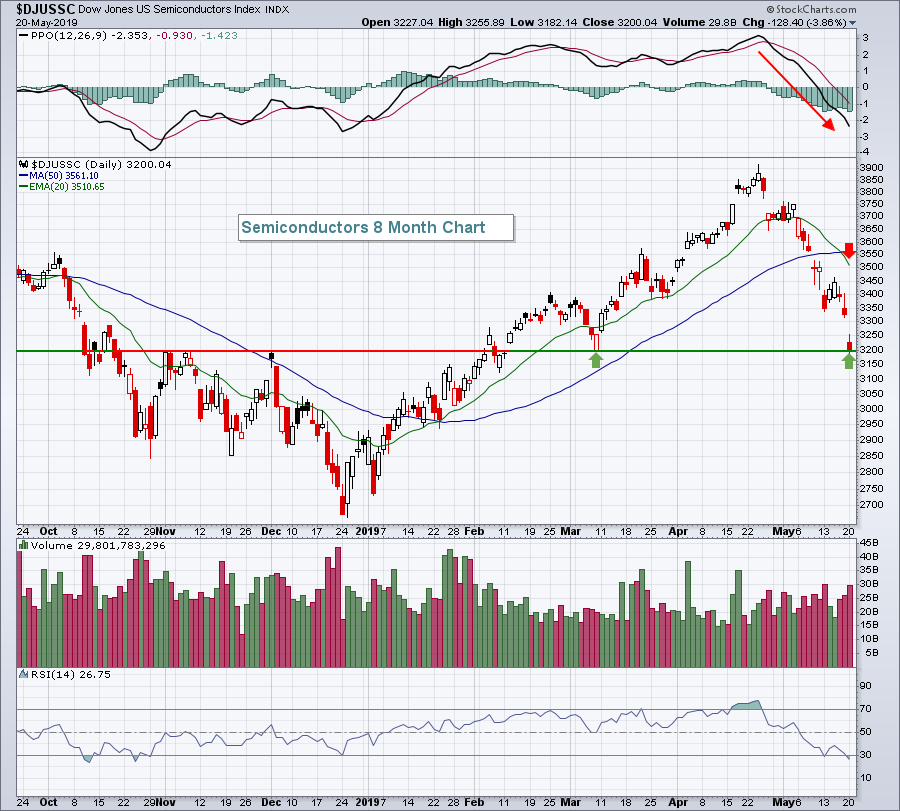

The Dow Jones Semiconductor Index ($DJUSSC, -3.86%) tumbled again on Monday, but there could be temporary relief provided by the March low price support level:

The bad news, however, is that PPO is abysmal - trending rapidly lower. Normally, that suggests any rally will fall short at the declining 20 day EMA, so keep that in mind on a bounce. I wouldn't assume we'll go straight through it. I'd need to see that first.

The bad news, however, is that PPO is abysmal - trending rapidly lower. Normally, that suggests any rally will fall short at the declining 20 day EMA, so keep that in mind on a bounce. I wouldn't assume we'll go straight through it. I'd need to see that first.

Historical Tendencies

I posted earlier this month that the first and last weeks of May are bullish. The balance of May (6th through 25th) has been challenging historically. The good news is that we're almost through it. Beginning next week, historical tail winds return. May 26th through June 5th has produced annualized returns of +51.82% on the NASDAQ since 1971.

Key Earnings Reports

(actual vs. estimate):

AZO: 15.23 - estimate, awaiting results

HD: 2.27 vs 2.16

KSS: .61 vs .67

TJX: .55 - estimate, awaiting results

(reports after close, estimate provided):

JWN: .43

PSTG: (.08)

SE: (.86)

TOL: .77

URBN: .26

Key Economic Reports

April existing home sales to be released at 10:00am EST: 5,370,000 (estimate)

Happy trading!

Tom