Market Recap for Tuesday, October 31, 2017

Don't look now, but crude oil prices ($WTIC) are on the verge of moving to a 2 1/2 year high. Energy (XLE, +0.33%) has shown life since ending its downtrend that began back in December 2016. Rising prices in crude would help to "fuel" the space in the months ahead so keep an eye out for that breakout:

Should crude clear $55 per barrel, I'd expect the recent XLE breakout and uptrend to continue.

Should crude clear $55 per barrel, I'd expect the recent XLE breakout and uptrend to continue.

Consumer staples (XLP, +0.84%) finally performed well on Tuesday, but there's much more technical work to do in this sector. I'd avoid it for now. Technology (XLK, +0.43%) also performed well (again) on Tuesday, but the key will be how Facebook (FB) and Apple (AAPL) react after their earnings reports are released later this afternoon and tomorrow evening, respectively.

Industrials (XLI, -0.40%) lagged yesterday with transports ($TRAN) struggling. Railroads ($DJUSRR) fell more than 1% after printing a shooting star candle last Friday amid a false breakout. 1600 will be a key support level for the group.

Pre-Market Action

The ADP employment report came in a bit stronger than expected, setting up a big nonfarm payrolls report on Friday. In the meantime, the FOMC will decide today whether it's going to raise interest rates now or wait for more information and possibly raise in December.

Dow Jones futures are significantly higher this morning, up 135 points as we approach the opening bell.

Current Outlook

Transportation stocks ($TRAN) broke out to all-time highs in September, clearing the mid-July high near 9750. The group has since pulled back on the heels of a negative divergence forming. It's now back to price support and approaching its rising 50 day SMA. I'd be looking for a reversal sooner rather than later:

If this truly is the beginning a longer-term uptrend in the TRAN, then the RSI reading at 45 is signaling we're very close, if not at, a near-term bottom. I'd be looking for money to rotate back into this group, especially railroads and truckers ($DJUSTK).

If this truly is the beginning a longer-term uptrend in the TRAN, then the RSI reading at 45 is signaling we're very close, if not at, a near-term bottom. I'd be looking for money to rotate back into this group, especially railroads and truckers ($DJUSTK).

Sector/Industry Watch

The Dow Jones U.S. Trucking Index ($DJUSTK) is a very interesting chart. There's a negative divergence that's suggesting slowing price momentum, but volume has been better than average during the latest push higher disputing that claim of slowing momentum. The rising 20 day EMA has provided excellent support over the past 2-3 months:

While we see many conflicting signals here, my "go to" signal is the combination of price and volume. I'm a fan of truckers so long as price support at 700 holds. A break below that level would also take out the rising 20 day EMA support, currently at 699. Loss of support there would likely trigger more intense short-term selling, but I'm not looking for that to occur.

While we see many conflicting signals here, my "go to" signal is the combination of price and volume. I'm a fan of truckers so long as price support at 700 holds. A break below that level would also take out the rising 20 day EMA support, currently at 699. Loss of support there would likely trigger more intense short-term selling, but I'm not looking for that to occur.

Historical Tendencies

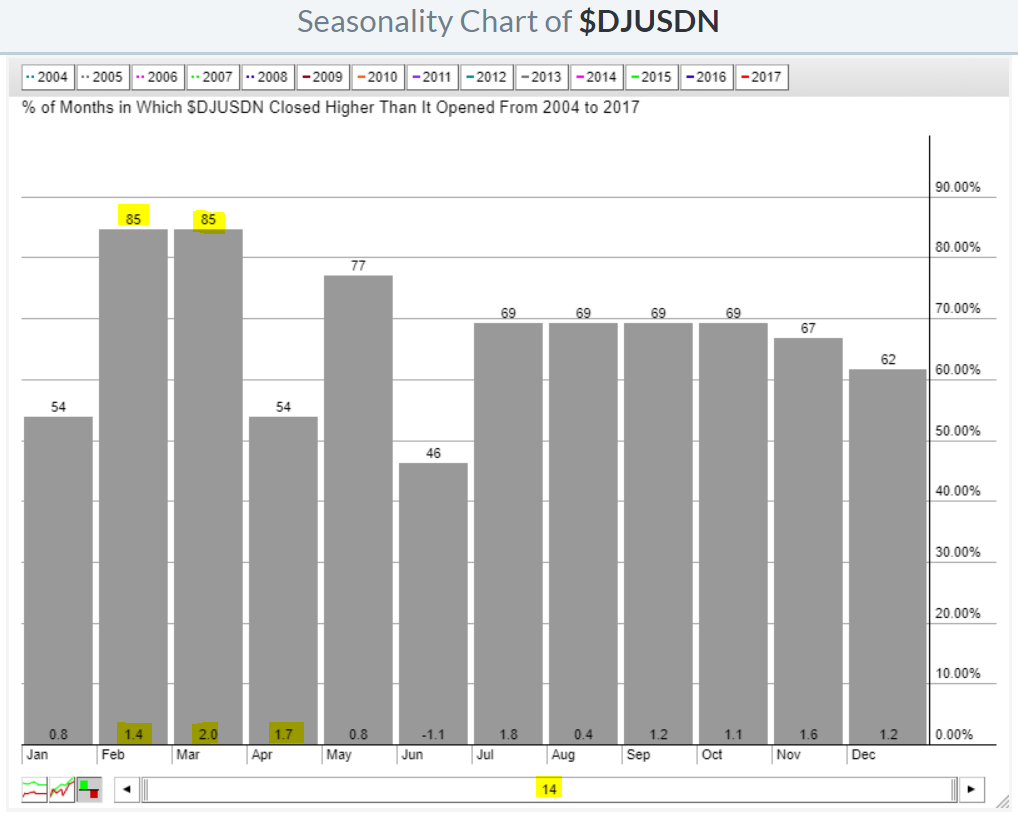

Defense stocks ($DJUSDN) tend to go up during almost any market and any period of the year. 11 of the 12 calendar months show average monthly gains over the last 14 years. The only exception is June where the group has averaged losing 1.1% over this period. Check out the group's seasonal tendency:

Defense stocks tend to move higher throughout the year, but the best period seems to be from February to April where the group has averaged gaining 5.1% per year over the past 14 years.

Defense stocks tend to move higher throughout the year, but the best period seems to be from February to April where the group has averaged gaining 5.1% per year over the past 14 years.

Key Earnings Reports

(actual vs. estimate):

AGN: 4.15 vs 4.06

CTSH: .98 vs .95

EL: 1.21 vs .98

SO: 1.12 vs 1.08

TEL: 1.25 vs 1.16

TRI: .68 vs .58

(reports after close, estimate provided):

ALL: 1.08

EQIX: 4.69

FB: 1.29

KHC: .83

MET: .90

OXY: .11

PRU: 2.71

QCOM: .81

TSLA: (2.45)

WPZ: .39

Key Economic Reports

October ADP employment report released at 8:15am EST: 235,000 (actual) vs. 210,000 (estimate)

October PMI manufacturing index to be released at 9:45am EST: 54.5 (estimate)

October ISM manufacturing index to be released at 10:00am EST: 59.5 (estimate)

September construction spending to be released at 10:00am EST: +0.0% (estimate)

FOMC policy statement to be released at 2:00pm EST

Happy trading!

Tom