Market Recap for Thursday, October 26, 2017

U.S. indices spent Thursday attempting to bounce back from losses earlier in the week. Based on that goal, it was mostly a successful day as most major indices finished with fractional gains. The NASDAQ lagged, ending the session with a loss of 0.11%. Most sectors were positive, although healthcare (XLV, -1.00%) was a very clear laggard. The Dow Jones U.S. Biotechnology Index ($DJUSBT) fell slightly more than 3% and that clearly weighed on healthcare. Health care providers ($DJUSHP, +1.19%) and medical supplies ($DJUSMS, +0.96%) bucked the biotech selling and actually finished quite strongly.

The XLV is dealing with a negative divergence on its daily chart so the move lower to test the rising 50 day SMA shouldn't be a total shock. Volume was big on the ETF yesterday and I'd like to see that key price support at 81 holds:

The pink arrows mark the potential MACD centerline "reset" and the 50 day SMA test - the two things I look for after a negative divergence prints. So long as we hold at 81, I remain short-term bullish the sector.

The pink arrows mark the potential MACD centerline "reset" and the 50 day SMA test - the two things I look for after a negative divergence prints. So long as we hold at 81, I remain short-term bullish the sector.

This has not just been a U.S. bull market. It's been a global bull market. Tokyo's Nikkei ($NIKK) surged to close last night above 22000, which is the highest level that index has seen in more than two decades.

Pre-Market Action

Despite the effects of a couple of devastating hurricanes, the Q3 GDP came in much better than expected, +3.0% (actual) vs. +2.5% (estimate). Solid earnings from NASDAQ giants Amazon.com (AMZN), Microsoft (MSFT), Intel (INTC) and Alphabet (GOOGL) are lifting the spirits of the NASDAQ as futures there are solidly higher and easily outperforming Dow Jones futures, which are higher by 17 points with a little more than 30 minutes left to today's opening bell.

Current Outlook

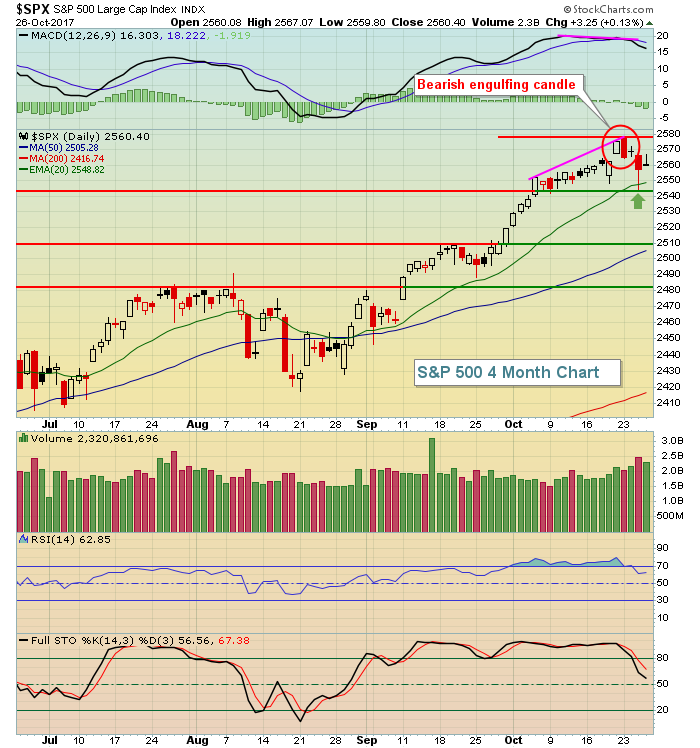

Well, U.S. markets are trying their best to ignore the historical headwinds that are typically faced this week in October. We saw heavier selling earlier this week, but so far the bulls have escaped further damage by hanging onto rising 20 day EMA support on the benchmark S&P 500:

Listen, we've been way overbought on the SPX and saddled with what appears to be slowing momentum (negative divergence). A bearish engulfing candle marked the recent top, so if you're bullish short-term, you really want to see the most recent high cleared - especially on a closing basis. To the downside, I view the 2544 intraday low from earlier this week to be extremely important technically. If that's lost, I'd look to the 50 day SMA as a next test.

Listen, we've been way overbought on the SPX and saddled with what appears to be slowing momentum (negative divergence). A bearish engulfing candle marked the recent top, so if you're bullish short-term, you really want to see the most recent high cleared - especially on a closing basis. To the downside, I view the 2544 intraday low from earlier this week to be extremely important technically. If that's lost, I'd look to the 50 day SMA as a next test.

Sector/Industry Watch

Healthcare had a rough day on Thursday and the reason was the awful performance of biotechs ($DJUSBT). The group has been solidly advancing on its weekly chart since breaking above 1800 this summer. The rising 20 week EMA is typically solid intermediate- to long-term support during uptrends. Check this out:

Biotechs are down more than 6% this past week, but I firmly believe it's nothing more than rotation that's been taking a toll here. Weekly RSI was above 70 for the past couple months and the group is seeing some much-needed selling to unwind its overbought conditions. I'd look for a bounce in the very near-term as price support near 1950 should hold.

Biotechs are down more than 6% this past week, but I firmly believe it's nothing more than rotation that's been taking a toll here. Weekly RSI was above 70 for the past couple months and the group is seeing some much-needed selling to unwind its overbought conditions. I'd look for a bounce in the very near-term as price support near 1950 should hold.

Historical Tendencies

At today's close, we will enter one of the most bullish periods of the year from October 27th's close to the close on November 6th. The NASDAQ, since 1971, has produced annualized returns of +83.69% over this period.

Key Earnings Reports

(actual vs. estimate):

ABBV: 1.41 vs 1.39

AON: 1.29 vs 1.27

CL: .73 vs .73

COL: 1.80 vs 1.80

CVX: 1.03 vs .99

E: .15 vs .22

LYB: 2.67 vs 2.43

MRK: 1.11 vs 1.03

PSX: 1.66 vs 1.62

RBS: .15 vs .15

SHPG: 3.81 vs 3.64

TOT: 1.04 vs .99

WY: .34 vs .31

XOM: .93 vs .89

Key Econonic Reports

Q3 GDP released at 8:30am EST: +3.0% (actual) vs. +2.5% (estimate)

October consumer sentiment to be released at 10:00am EST: 101.0 (estimate)

Happy trading!

Tom