Market Recap for Tuesday, October 17, 2017

Healthcare stocks (XLV, +1.34%) led the Dow Jones to yet another all-time high close as the Dow traded above 23000 on an intraday basis for the first time in its history, closing just beneath that psychological level at 22997. It was really about the Dow Jones on Tuesday as the S&P 500 and NASDAQ both finished close to their respective flat lines and the small cap Russell 2000 fell 0.34%.

Leadership on the Dow came from two healthcare stocks that reported excellent quarterly earnings results before the bell on Tuesday. United Healthcare (UNH, +5.53%) and Johnson & Johnson (JNJ, +3.43%) both climbed to all-time highs after reporting results that topped Wall Street consensus estimates. Here are their charts:

UNH:

The earlier negative divergence on UNH played out with price action falling back to test the 50 day SMA and reset the MACD at its centerline (pink arrows). The breakout comes with accelerating momentum so I'd look for further strength ahead.

The earlier negative divergence on UNH played out with price action falling back to test the 50 day SMA and reset the MACD at its centerline (pink arrows). The breakout comes with accelerating momentum so I'd look for further strength ahead.

JNJ:

Rectangular consolidation characterized the JNJ chart prior to its breakout a few days ago. Tuesday's action simply solidified that breakout with excellent volume confirmation.

Rectangular consolidation characterized the JNJ chart prior to its breakout a few days ago. Tuesday's action simply solidified that breakout with excellent volume confirmation.

Financials (XLF, -0.49%) were the weakest sector on Tuesday as key interest-sensitive areas like banks ($DJUSBK), life insurance ($DJUSIL), asset managers ($DJUSAG) and investment services ($DJUSSB) all underperformed with the 10 year treasury yield ($TNX) reversing earlier gains to finish down for the day. The latter group struggled despite a solid quarterly earnings report from Goldman Sachs (GS) before the market opened.

Pre-Market Action

Housing starts came in better than anticipated this morning, but building permits fell short. The bond market has spoken as the TNX has jumped nearly four basis points this morning in reaction to the September report. This could be the move that finally clears 2.40% yield resistance and, if so, financials should perform very well. Goldman Sachs (GS) and Morgan Stanley (MS) both reported solid results yesterday and the latter appeared to break out intraday before the TNX tumbled into the close, reversing many gains in financial stocks. With the TNX higher this morning and the beige book on deck at 2pm EST, these financial stocks could see a resumption of leadership.

Asian markets were mostly higher overnight, European markets are mostly higher this morning and U.S. futures are suggesting we're going to follow global markets higher. Dow Jones futures are up 91 points at last check, though futures gains on other indices were less robust.

Current Outlook

A bullish development on Tuesday involved the consumer stocks. While neither discretionary (XLY, +0.05%) nor staples (XLP, -0.37%) finished the day as big winners on Tuesday, I believe the relative strength of XLY vs. XLP (XLY:XLP) acted in very bullish fashion after testing relative support and its rising 20 day EMA. Check it out:

A rising XLY:XLP ratio indicates traders' appetite for risk, a necessary component of a sustainable bull market rally. While our major indices deserve some profit taking at some point, the overall signal remains quite bullish into year end and 2018.

A rising XLY:XLP ratio indicates traders' appetite for risk, a necessary component of a sustainable bull market rally. While our major indices deserve some profit taking at some point, the overall signal remains quite bullish into year end and 2018.

Sector/Industry Watch

Healthcare (XLV) was the clear leader on Tuesday and UNH and JNJ helped to fuel a key breakout in the sector ETF:

The solid black lines outline a bullish ascending triangle pattern. The "measurement" (red vertical dotted line) of this pattern is calculated by taking the difference between the top of the triangle (83) and the bottom of the triangle (81), which equals roughly 2 points. Add that to the breakout level of 83 and you have a short-term target price of 85.

The solid black lines outline a bullish ascending triangle pattern. The "measurement" (red vertical dotted line) of this pattern is calculated by taking the difference between the top of the triangle (83) and the bottom of the triangle (81), which equals roughly 2 points. Add that to the breakout level of 83 and you have a short-term target price of 85.

Historical Tendencies

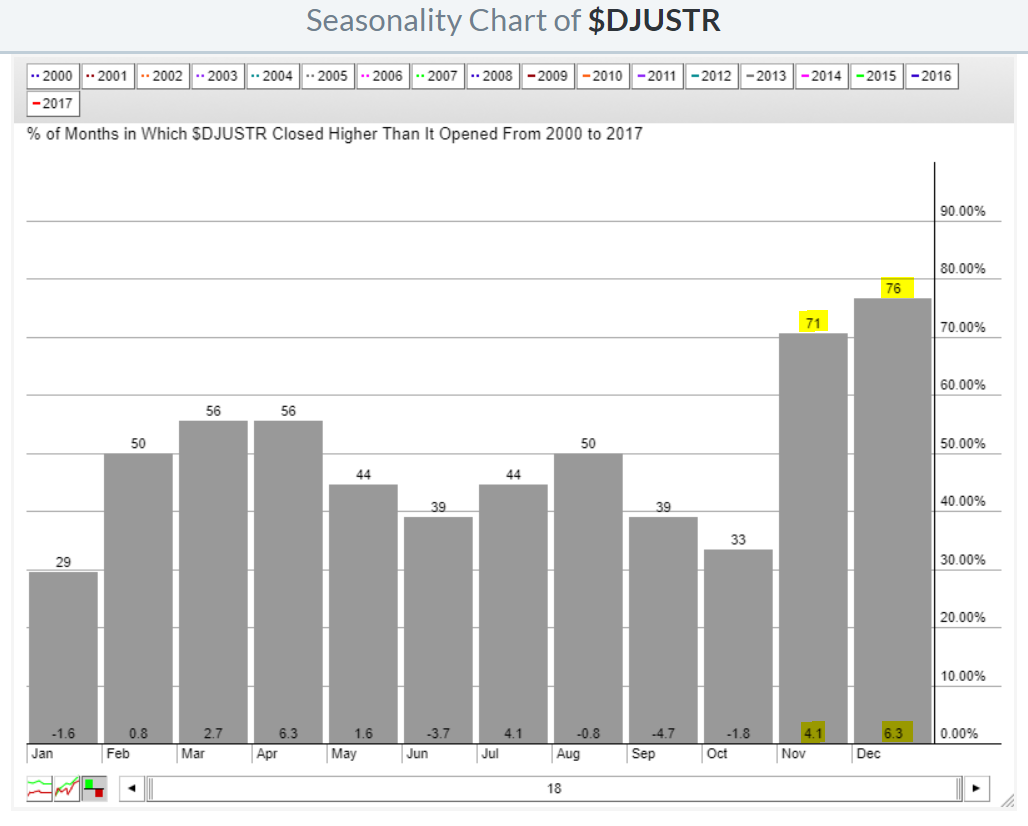

Looking ahead to November and December, the Dow Jones U.S. Tires Index has a history of performing very well in both months. The index is also testing its rising 20 day EMA currently in bullish fashion. Here's the seasonal data:

That looks bullish indeed.

That looks bullish indeed.

Key Earnings Reports

(actual vs. estimate):

ABT: .66 vs .65

ASML: 1.52 vs 1.28

MTB: 2.24 vs 2.40

NTRS: 1.20 vs 1.12

USB: .88 vs .88

(reports after close, estimate provided):

AXP: 1.47

CCI: 1.17

EBAY: .48

KMI: .14

UAL: 2.12

Key Economic Reports

September housing starts released at 8:30am EST: 1,127,000 (actual) vs. 1,170,000 (estimate)

September building permits released at 8:30am EST: 1,215,000 (actual) vs. 1,238,000 (estimate)

Beige book to be released at 2pm EST

Happy trading!

Tom