Despite the healthy move in some of these stocks already, there are several compelling reasons why these stocks deserve some attention.

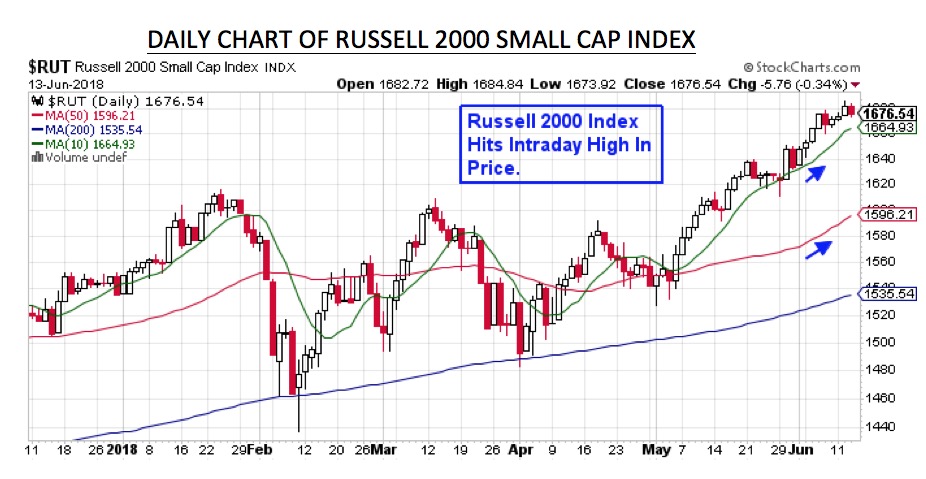

With the Russell 2000 hitting another new high today, small cap stocks continue to outdistance larger cap stocks. Year to date, these smaller names are now up over 10% vs the S&P 500’s return of 3.8%. There are several sound reasons why these Small Cap stocks are outpacing the broader markets as well as one very important main reason that points to a continued outperformance of these stocks going forward.

One of the positives for stocks of small companies is that they have less international exposure which buffers them from the impact of rising bond yields, a strengthening dollar as well as any trade tensions.

In addition, these smaller companies are more leveraged to benefit from the newly enacted corporate tax cuts and reduced Federal regulations. Add a growing economy and we can be led to the most impactful reason that Small cap stocks are leading the markets.

This number one reason is strong reported earnings as well as a positive earnings outlook going forward. With Q1 results behind us, Wall Street’s consensus 12-month forward earnings expectations for the Russell 2000 Index currently stand at 26% versus only 11% for the large cap Russell 1000. (per Thompson Reuters). This would be the best showing for these stocks in many years.

This is big news as it’s been proven that one of the primary drivers of a stock’s advance is strong earnings. Having studied the charts of countless big, winning stocks over my many years at William O’Neil & Co., I can tell you that accelerating earnings consistently pushes stocks higher.

With strong tailwinds behind these smaller stocks and the outlook being bright, let’s look at ways to uncover stocks that may have more upside potential.

As with any stock selection, you’ll want to make sure you’re in a “healthy” part of the markets that are experiencing money inflows from investors attracted to the prospects for the group as well as the underlying stocks within that group.

Currently, that would take us to Technology (XLK) and Consumer Staple (XLY) stocks as both sectors are hitting a new high in price follow a strong 1st quarter earnings season. From there, you can use Stockchart’s Industry Summary page to detect sub-group strength within a sector. This page provides intraday performance information and when viewed regularly, you can quickly uncover groups that have consistent outperformance. By clicking on that group, you get a view of the stocks within it.

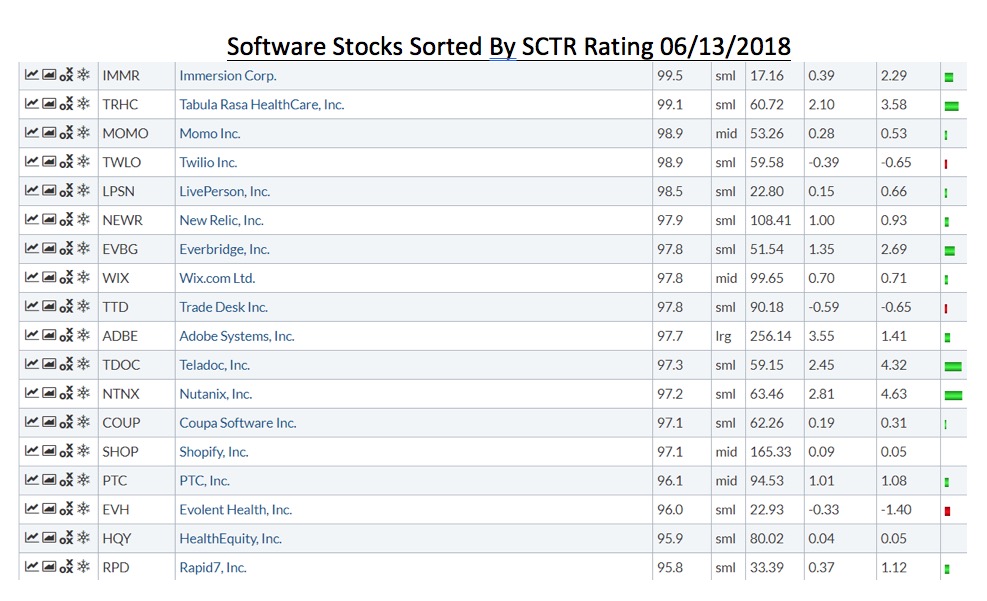

Below is a snapshot of stocks in the Software group as this as been a recently strong area within Technology. This list is sorted by the SCTR rating which is an indicator developed by John Murphy that points you toward stocks that look technically attractive. As you can see, the list is populated with many smaller cap stocks that can be reviewed for fundamental strength.

Many of these stronger Software stocks may appear extended given their recent runs however, strong uptrends certainly can last, provided the market backdrop remains healthy. And while the future looks bright for these stocks, you’ll want to use your chart reading skills to guide you in your buying and selling as these smaller companies have higher trading volatility.

For those who want to brush up on these skills, be sure and visit my website to view some of my more popular courses.

Warmly,

Mary Ellen McGonagle

President

MEM Investment Research