For those who want to deal with physical property, the profit potential of real estate is clear. Now it can be an even better investment. • Congress authorized special ‘Opportunity Zones’ in 2017, but the necessary federal regulations weren’t released until just last week. The Treasury’s announcement is the starting gun for a 10-year period in which you pay NO CAPITAL-GAINS TAX on investments in these zones.

Figure 1. Profitable real-estate investments have just become a lot MORE profitable, thanks to tax-free gains that Congress has authorized for the next 10 years or more. Image by Karramba Production/Shutterstock.

• Part 2 of a series. Part 1 appeared on Apr. 23, 2019. •

In Part 1 of this series, we saw that buying residential housing can be much more attractive in the long run than renting the housing you may need. The numbers on long-term ownership versus renting are so well known that this fact may seem obvious.

What’s not so clear is the additional benefit you can obtain if a child or an adult in your family needs support for an intellectual or physical disability. Buying a single-family dwelling in a residential development that’s pedestrian-friendly and specifically designed to assist people who have social challenges — a unique kind of “pocket neighborhood,” as described in Part 1 — can net you more than a million bucks during a long investing career. Compare that with paying by the month to rent a room for a socially challenged family member in an assisted-living facility or the like. That’s an ongoing expense that would build no equity for you.

As of today, there aren’t very many of these walkable, supportive neighborhoods. But that’s about to change — in a big way.

The difference is being caused by so-called Opportunity Zones (OZs). In a surprisingly bipartisan move, Congress in 2017 authorized massive tax cuts for investors in these designated parcels.

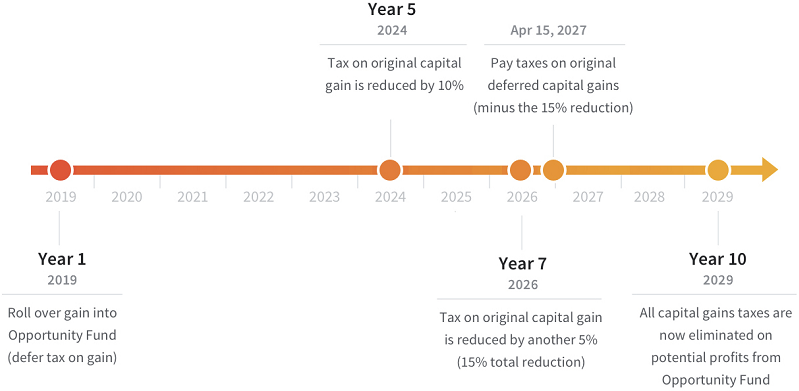

Actually, “cuts” is an understatement. You’ll pay ZERO TAX on any capital gains you earn from an OZ investment that you hold for 10 years or more. As an additional sweetener, if you sell securities this year (Year 1) and direct your capital gains into an OZ, you can defer ANY TAX on the gain for as long as seven years. On Apr. 15 of that year, your capital-gains tax will be only 85% of what you would have paid on the capital gains you received in Year 1. (See Figure 2.)

The prospect of paying ZERO capital-gains tax is already attracting an influx of wealth into these zones — literally billions of dollars. Some of that money will flow into the construction of new residential properties or the renovation of existing ones, whether multi-family apartments or single-family houses. In locations where Opportunity Zones contain land that, by ordinance, is buildable to a density no higher than single-family dwellings, it’s fertile soil for walkable, pocket-neighborhood developments to spring up.

Figure 2. You can defer for up to seven years any capital-gains tax on securities you sell, so long as you invest the proceeds into an Opportunity Zone. Then, if you hold an OZ investment for 10 years, you pay ZERO TAX on any capital gains you realize. Illustration by Fundrise.com.

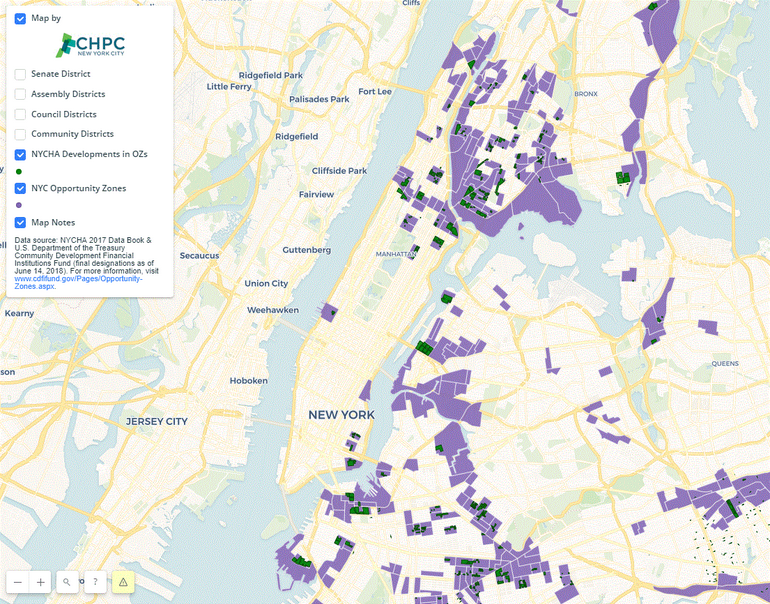

Exactly where are these no-tax zones? They’re all over the map! (See Figure 3.)

To make OZ designations, Congress authorized state and local governments to consider every census tract that had a poverty rate higher than 20%. To make things even more interesting, every tract adjacent to a selected tract could be considered for OZ status as well, if such a tract had a median income no more than 25% greater than the adjacent high-poverty area. That meant 57% of America was theoretically eligible to become an OZ.

Cities, counties, states, Indian nations, and US territories between themselves designated almost as many areas as the legislation allowed. (The constraint was that most jurisdictions could select only 25% of the low-income census tracts, plus a limited number of adjacent tracts.) At this writing, about 12% of all US census tracts are OZs. That comprises more than 8,700 neighborhoods, both urban and rural. Small jurisdictions with few census tracts, such as Puerto Rico, were allowed to designate 100% of their land area as OZs. That’s a lot of tax-free real estate opportunities!

Opportunity Zones have been held back in the past year by the federal government’s lack of clarity on exactly which financial operations in an OZ count as “qualified businesses.”

That uncertainty ended on Apr. 17, 2019, when the Treasury Dept. announced suitable regulations. Under the new rules, a business is qualified if it meets any ONE of the following conditions:

— At least 50% of a business’s revenue is generated in Opportunity Zones; or

— The properties and managers that produce at least 50% of the business’s revenue are in OZs; or

— At least 50% of the hours or wages of the business’s employees are generated in OZs.

You’re missing real estate profits that are already flowing

Figure 3. About 12% of the census tracts in the US — more than 8,700 areas, mostly in low-income localities, everthing from urban to rural — have been designated as Opportunity Zones. This image indicates OZs in New York City. Source: Citizens Housing Planning Council of New York City (CHPC).

Just how much profit can be made in Opportunity Zones? Zillow.com recently reported that sale prices of residential properties in designated OZs jumped more than 20% in just one year. Residential sale prices within nearly identical census tracts that were eligible but not designated rose only in the single digits. That’s a big difference. The sellers of the properties that increased one-fifth in value in a mere 12 months made a chunk of change just for owning land that was included in a new OZ.

Does this mean you should rush out and buy run-down residential properties? Absolutely not!

“Flipping” real estate is sometimes profitable but not always fun. For one thing, to get the tax breaks you’d have to comply with all of the regulations affecting OZ businesses. For example, anyone who buys land in an OZ is required to build new structures or improve the existing ones enough to increase the resulting value of the property at least 100%, in order for the project to qualify.

Individual investors who aren’t multi-millionaires or experienced real-estate speculators will be much better off investing in a fund that spreads its risk across hundreds of OZ businesses across America.

One such diversified portfolio is managed by Fundrise.com. Many private equity firms require investors to have a seven-figure net worth or meet other financial conditions. By contrast, Fundrise accepts applications from individuals who wish to commit as little as $25,000 of liquid assets. Smaller buy-ins benefit from the same tax breaks as much larger stakes. Fundrise’s website provides a detailed explanation of the OZ investing process, plus a curated list of what its land-use experts consider to be the 10 most attractive locations in the country, from the standpoint of profit potential.

What about the program’s implied social benefit for the affected communities? It would be a wasted opportunity, so to speak, if Opportunity Zone developments simply tore down housing that’s currently affordable for moderate-income families and replaced the dwelling units with expensive, luxury housing.

To discourage the loss of affordable housing, many OZs, but not all, are mainly commercial strips with few dwelling units to tear down. For those zones that are primarily residential, HUD Secretary Ben Carson recently stated that his agency will give “preference points” in its grant process. These points would aid developers who add, rather than subtract, affordable housing units in a community, according to an article in The Real Deal, a property-development website.

How can HUD preference points influence developers more than ZERO TAXES will? This is one of the programs’ known unknowns. It’s the kind of risk that individual investors should do as much as possible to diversify away. One means of doing that is entrusting money to a fund — rather than to a single speculative project — and then only with money an investor can afford to lose and won’t need access to in the next 10 years.

In the third and final part of this series, we’ll see some specific, investable projects that are already underway.

• Part 3 appears on Apr. 30, 2019.

With great knowledge comes great responsibility.

—Brian Livingston

Send story ideas to MaxGaines “at” BrianLivingston.com