Selecting a college savings plan from the scores that are out there is daunting, even for financial professionals. • Most ‘529-type’ tax-deferred programs are very restricted in their reallocation opportunities and don’t include a full set of global asset classes. Eliminating the most limited and costly plans can help you narrow down to a managable number the ones you should consider.

• Part 1 of this column appeared on Dec. 6, 2018.

So far in this column, we’ve seen that most college savings programs — called “529 plans” in the US and other names elsewhere — are open to investors from far and wide. Although the vast majority of plans are administered by a state or provincial government, many of the programs welcome accounts from residents almost wherever they may live.

The biggest problem with 529 plans for serious investors is that most of the programs focus on mutual funds that hold only stocks and bonds. For true diversification and an ideal asset allocation, alternatives such as real estate and commodities are needed.

A second issue is the way the plans steer you toward a “declining equity glide path.” This is usually known in 529 jargon as an “age-based portfolio.” Similar to target-date funds in retirement accounts, age-based portfolios start out with a high percentage of your money in stocks when your child is young and decline to a high percenage in bonds over the years.

The aggressive allocation of the Vanguard 529 College Savings Plan, for example, puts 100% of your money in global stock indexes (70% US, 30% non-US) if your future college student is currently 0 to 5 years of age. The equity portion of the portfolio then drops in stages until your money is 100% in bonds when the student is 18. Concentrating your money into a single asset class can subject you to crashes during equity bear markets and poor performance when bond prices are collapsing as interest rates rise.

A third concern is that 529 plans restrict the number of changes you can make in your portfolio as market conditions change. In the US, account holders can change the asset allocation of their money only twice a year. Prior to 2015, this was permitted only once a year!

Groups such as the College Savings Plans Network, a consortium of US 529-plan administrators, are agitating for account owners to be allowed to reallocate at least four times a year. Until a reform like that occurs, as a Wall Street Journal article notes, you may be able to work around the twice-a-year limit by changing the name of an account’s beneficiary, which can be done “as often in a given year as desired.” You can reallocate whenever the beneficiary changes. You’re also permitted to hold more than one 529 account, and you can invest each one in a different way. (Important: If you use multiple accounts, you must keep your combined contributions under allowable limits.)

In the best of all possible worlds, we could save money for our kids’ college expenses in a tax-deferred account while taking advantage of 21st-century developments such ultra-low-cost ETFs and the well-established principle of momentum. (For more on how momentum works, see my Muscular Portfolios summary.)

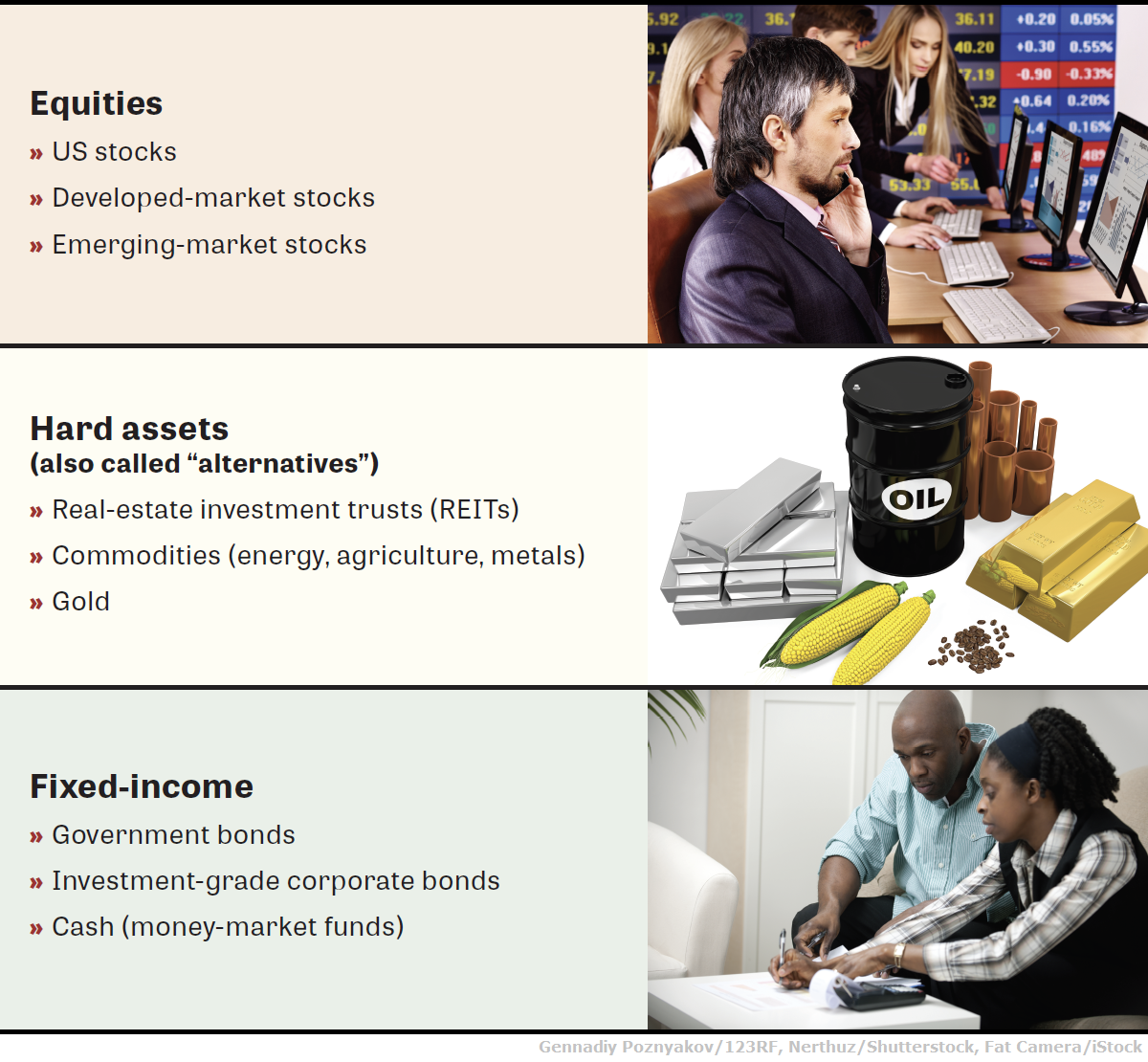

But in order to profit from those breakthroughs, we first need to find 529 plans that offer low-cost investments and a wide variety of asset classes. First, let’s define what asset classes we’re looking for.

Nine basic asset classes for diversification and momentum

Figure 1. Although these simple categories can be divided into smaller and smaller subsets, the nine asset classes shown above provide enough choices for a long-term portfolio.

Figure 1. Although these simple categories can be divided into smaller and smaller subsets, the nine asset classes shown above provide enough choices for a long-term portfolio.

Most 529-type plans offer at least one type of stock investment and one or more fixed-income fund (bonds or cash). But these programs rarely offer alternatives that can provide adequate diversification, including real-estate investment trusts (REITs), commodities, and precious metals, such as gold.

You wouldn’t want to hold all of these asset classes all the time. But holding the ones that have the strongest momentum — as determined by specific rules, not opinions — is a way to tilt your portfolio toward the assets that are statistically the most likely to rise. As researchers have proven for decades, asset classes that have gone up in the past 3 to 12 months have a tendency to rise in the following month or more.

College savings programs that feature ETFs and alternatives

Since you’re not limited to the 529 plans in your local area, you can look far afield. The following two examples are the kinds of programs that offer more than old-line college savings accounts do:

• Upromise 529 Plan. This program, a subsidiary of State Street Global Advisers, allows you to build a diversified portfolio using low-cost index ETFs rather than mutual funds. The selection of equity ETFs, as you might imagine, is drawn from State Street’s exchange-traded funds such as SPY (S&P 500) and SPDW (developed-world equities ex-US). But, unlike many 529 plans, you can also choose ETFs representing emerging-market equities (SPEM), US REITs (RWR), and non-US REITs (RWX).

Note: In this plan, you don’t technically own ETF shares, you own a position in a Upromise managed account. But the difference is academic. And Upromise’s use of ETFs can make its accounts less expensive than other 529 plans that rely heavily on mutual funds, which typically charge higher annual fees.

Upromise doesn’t currently offer any commodity or precious metals ETFs, unfortunately. But the emerging-market and real-estate alternatives are a good start toward a smarter 529 portfolio. The state of Nevada administers a Upromise fund, but the accounts are available to residents of any US state and Puerto Rico. For a complete list of the available investment options, see the Upromise static portfolios page.

• CollegeCounts 529 Plan. In addition to the emerging-markets and real-estate exposure that Upromise offers, the CollegeCounts program includes the Credit Suisse Commodity Return Strategy 529 Portfolio. This is a fund that tracks the Bloomberg Commodity Index.

As previously mentioned, commodities aren’t something you want to hold and forget about. Indexes of commodities have sunk like a rock in recent years. But as a safe haven when global equity markets are crashing, commodity indexes are a nice alternative for people who are using momentum to determine their asset-rotation strategy.

For a complete list of all of the asset classes available, visit Saving for College’s CollegeCounts page and scroll down to “Individual Investment Options.”

In the remaining parts of this column, we’ll examine the costs and long-term trading opportunities of the ideal college savings plan.

• Parts 3 and 4 appear on Dec. 11 and 13, 2018.

With great knowledge comes great responsibility.

—Brian Livingston

CEO, Muscular Portfolios

Send story ideas to MaxGaines “at” BrianLivingston.com