I confess! I’m messing with you a bit with respect to Action Practice #24. On the surface, the exercise is simply to allocate 100% of your funds, apportioned amongst each of the six asset classes. As a reminder, I've listed those six asset classes below, including their respective ticker symbols.

- Vanguard Total Stock Market Index (VTI)

- MSCI Europe, Australia and Far East - EAFE Index (EFA)

- SPDR S&P Biotech ETF (XBI)

- Powershares Commodity Index (DBC)

- Dow Jones Global Real Estate (RWO)

- iShares Gold Trust (IAU)

In reality, there are three essential questions to answer before jumping into the exercise:

- Which of these asset classes would you deem CORE holdings? Which would you label EXPLORE holdings? Correlations matter here — i.e. Biotech (XBI) might be a better candidate for EXPLORE versus CORE.

- Do you appreciate and embrace your personal investing timeframe? How much time, effort and frequency are you willing to spend on rebalancing your portfolio?

- Once you’ve answered the first two questions, you are better prepared to move forward and decide whether you will deploy a strategic or tactical approach to your portfolio allocations. So much of investing success is based on building a solid foundation and that takes patience. Great investors have that patience. (Warren Buffett comes to mind)

Lastly, before you dive into assigning allocation percentages, I’d ask you to revisit the blog that we wrote titled “The Only Free Lunch in the Investing Arena”. It lays out ten reasons why you should embrace asset allocation seriously with both arms, and it will help you take this exercise even more seriously. Our objective is to have you understand what a high-leverage activity this is for your portfolio’s health and wealth.

The first matrix we present is a graphic of the six asset classes over a two-year period. The strategic decision you make here is to weight all six classes identically. There are plenty of academic studies showing that if you select your asset classes carefully, this equal weight approach is an effective allocation. Your job as an investor is simple. Rebalance the asset classes to maintain their equal weight. The investing methodology is straightforward — whether you do this every half-year or annually or whether you use seasonality to your benefit to buy and sell according to monthly strengths or weaknesses of your equities. It’s simple but effective.

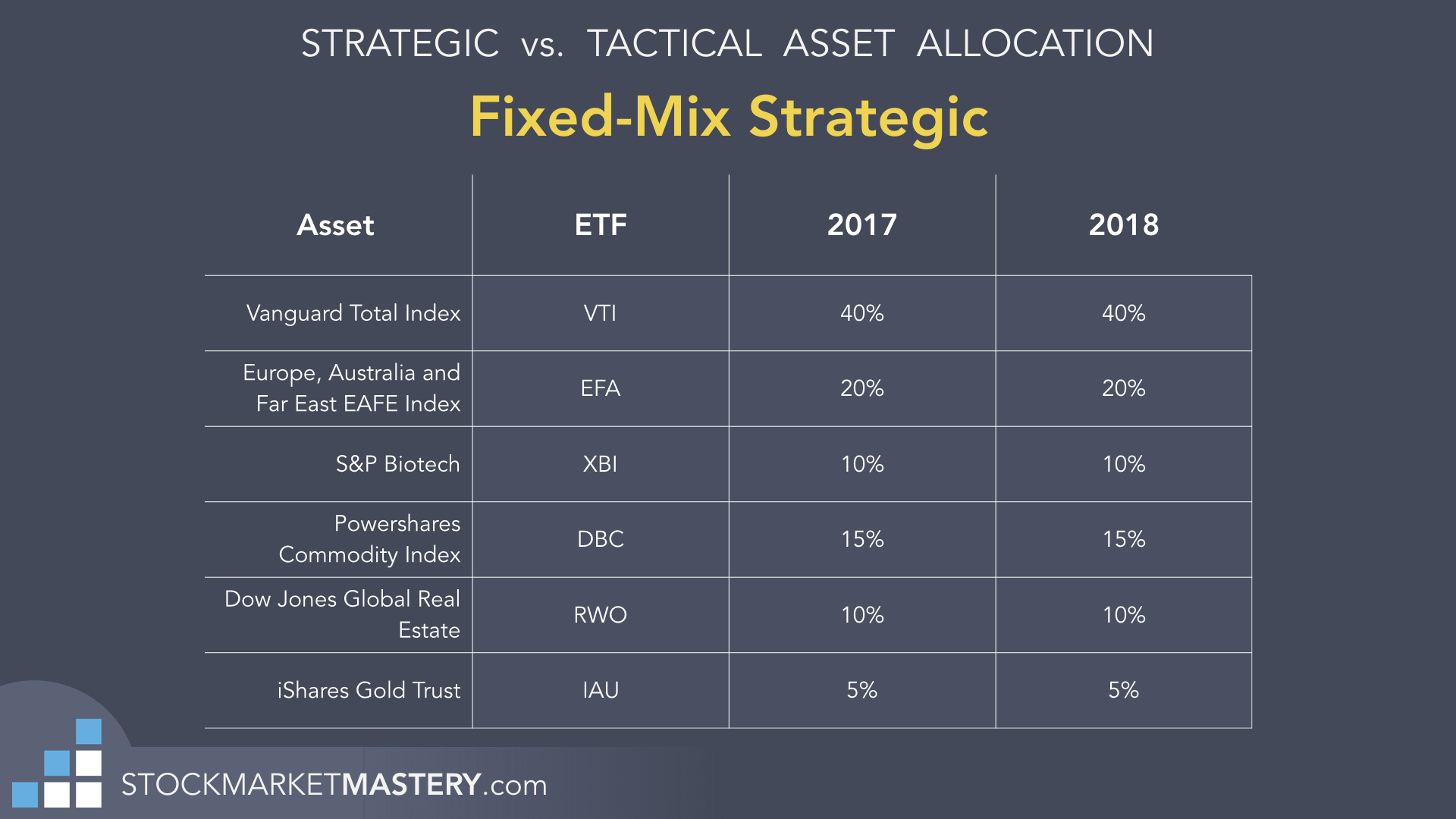

In the second example, the same six asset categories exist, but notice here the strategic decision allocates very different percentages to each of the six asset classes. This fixed mix allocation is, however, similar to the equal-weight profile because the investor’s job is one of regularly rebalancing the six asset classes to maintain the assigned strategic percentage allocation year over year.

The key decisions here are once again choosing the appropriate asset classes and then allocating percentages to each that you are comfortable with. Once more, the investing methodology is relatively uncomplicated. It just requires discipline.

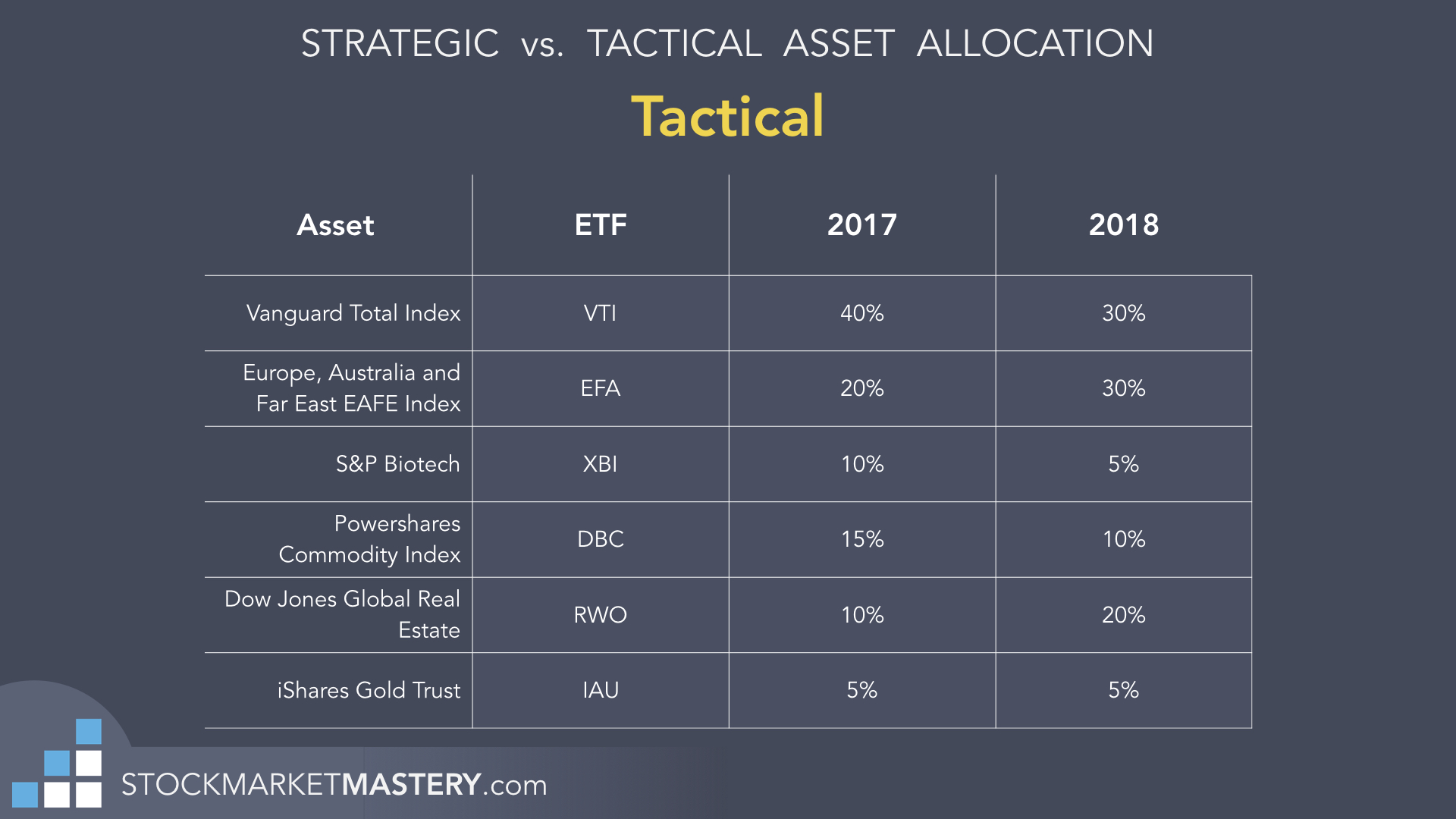

The third example is one of tactical allocations, and it requires the most time, experience and market savvy. From the matrix, you can see that this investor feels that international markets will outperform domestic USA markets moving forward. Therefore, the allocation to VTI for 2018 is reduced to 30%, while EFA is increased from 20% to 30%. The investor also decides to reduce his/her exposure to Biotech (XBI) from 10% to 5%. The investor is clearly bullish on Global Real Estate and therefore doubles that exposure from 10% to 20%. With Commodities and Gold, the investor is mildly bearish and reduces his/her exposure slightly. Clearly, there is much more actual investment management required in this third scenario and sophisticated decision making, but the investor believes he/she will add to his/her performance at year-end by implementing a tactical approach.

This Week's Action Practice

We’d like to step back and revisit two of the asset classes in our hypothetical portfolio to ask how and why we chose to use S&P Biotech (XBI) and iShares Gold Trust (IAU) as the best representatives of their specific asset classes.

We suggest you revisit the blog “Best of Breed”. The fact is that there are many options from which to choose. The universe consists of individual stocks, ETFs and sector-specific mutual funds. The exercise is to challenge our choices of XBI and IAU as “Best of Breed” and to offer alternative ticker symbols which you feel are superior. We will then present our case for both the Biotech and the Gold choices we have made.

Good luck!

p.s. You're Invited!

Without a doubt, the most powerful catalyst I've found to learn, grow and improve as an investor is the sharing of wisdom and knowledge. To learn not only from your own experiences in the market, but also from the experiences of those around you, that is a truly invaluable opportunity. With that in mind, Grayson and I are thrilled to announce our upcoming Investors Boot Camp, which kicks off this May 19th - 20th here in Seattle.

2 days. 14 investors. 1 transformative experience.

Join us for two enriching days in my downtown Seattle trading office among a small group of just 14 investors. With a seminar this size, in a unique environment this engaging and intimate, it will be unlike any other investing event you've ever attended. It's no wonder that, for Grayson and I, the Boot Camp has quickly become our favorite teaching forum. Whether you're new to the markets or a seasoned trader, the Boot Camp will make you a better investor. Period.

To learn more or register for our Spring 2018 Investors Boot Camp, CLICK HERE.

Trade well; trade with discipline!

- Gatis Roze, MBA, CMT

- Author, Tensile Trading: The 10 Essential Stages of Stock Market Mastery (Wiley, 2016)

- Presenter of the best-selling Tensile Trading DVD seminar

- Presenter of the How to Master Your Asset Allocation Profile DVD seminar

- Developer of the StockCharts.com Tensile Trading ChartPack