Southwest Airlines (LUV) is in a long-term downtrend and the recent failure near the death cross points to further downside.

Southwest Airlines (LUV) is in a long-term downtrend and the recent failure near the death cross points to further downside.

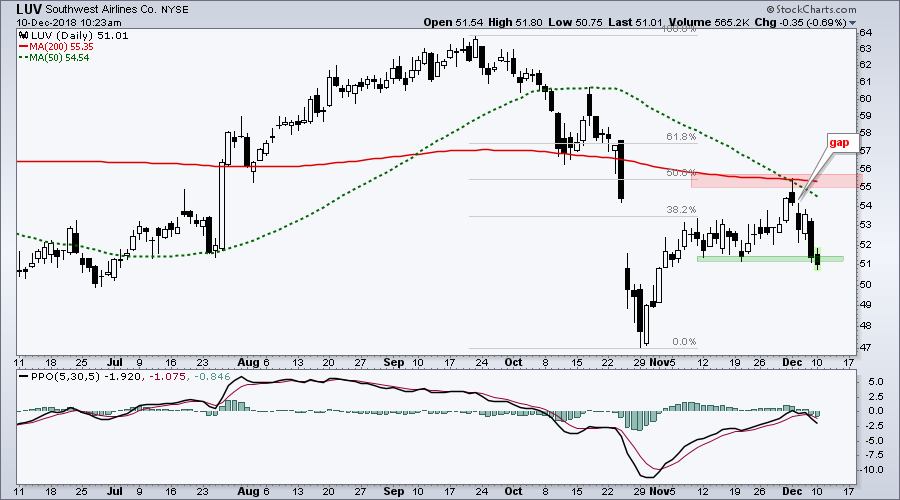

First and foremost, the long-term trend is down because LUV hit a new 52-week low in late October and price is below the 200-day SMA. In addition, the 50-day SMA just crossed below the 200-day.

After gapping down and hitting a new low, the stock bounced back to the 55 area in early December. This bounce, however, just retraced 50% of the prior decline, which is normal for a counter-trend bounce.

The bounce hit resistance as the stock gapped down last week and broke below the mid November low today. Also notice how the stock reversed right at the death cross. As cool as this sounds, it is probably just a coincidence and I do not consider this cross point as a resistance level.

The indicator window shows the PPO (5,30,5) turning down over the last few days and the PPO moving below its signal line. Thus, momentum is negative again and pointing down.

- Arthur Hill, CMT

Senior Technical Analyst, StockCharts.com

Book: Define the Trend and Trade the Trend

Twitter: Follow @ArthurHill