ChartWatchers April 21, 2018 at 05:20 PM

Editor's Note: This article was originally published in John Murphy's Market Message on Thursday, April 19th at 12:11pm ET BLOOMBERG COMMODITY INDEX IS NEAR AN UPSIDE BREAKOUT... This week's surge in commodity prices is starting to attract a lot of attention... Read More

ChartWatchers April 21, 2018 at 11:43 AM

One of the most over used cliches in the stock market, in my opinion, is "go away in May". First of all, it's simply bad investment advice. Since 1950 on the S&P 500, the May 1st to July 17th period has produced annualized returns of 6.00%... Read More

ChartWatchers April 21, 2018 at 09:46 AM

The Percentage Price Oscillator (PPO) is mostly used as a momentum oscillator, but chartists can also use it to define the trend, even the long-term trend... Read More

ChartWatchers April 20, 2018 at 07:14 PM

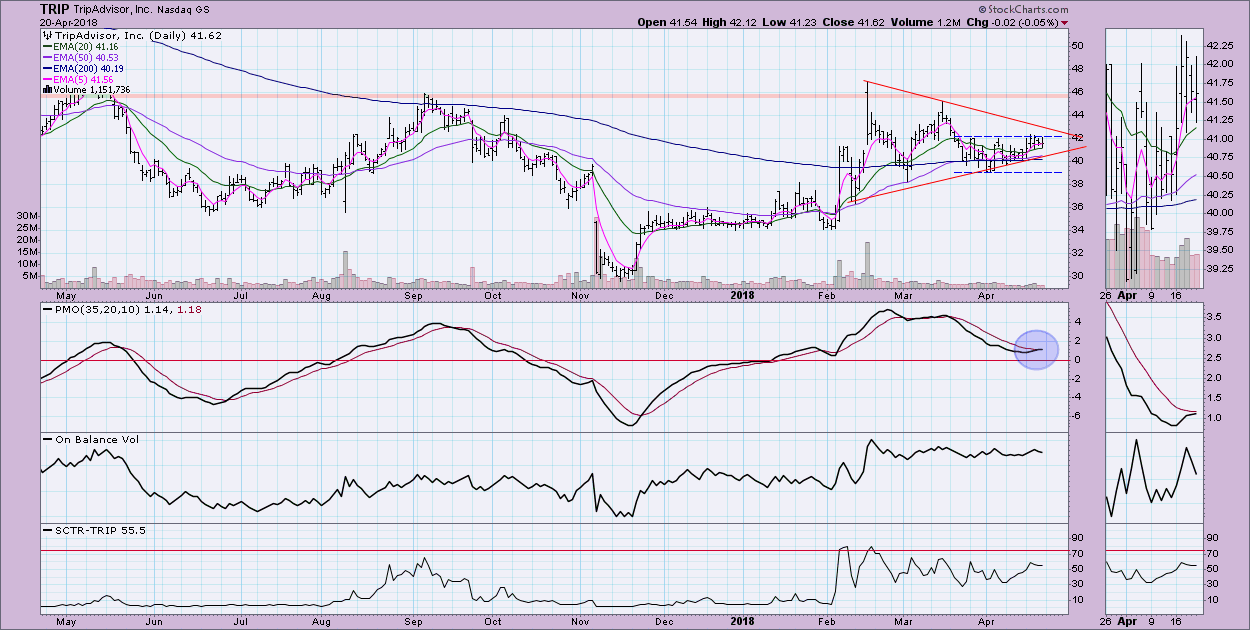

This afternoon I ran one of my PMO scans (you'll find the link to my most popular scan in the link at the bottom of this article) and found two Travel & Tourism stocks that I found quite interesting... Read More

ChartWatchers April 20, 2018 at 04:53 PM

Financials have been down and out recently but the last two days they showed some resiliency in the face of broader selling. The Bank Index looks set to turn higher... Read More

ChartWatchers April 20, 2018 at 04:34 PM

Anytime we issue a trade alert to members at EarningsBeats it must carry a minimum reward to risk of at least 2 to 1. In fact we rarely consider getting involved in a trade unless the potential reward to risk is at least 3 to 1 or higher... Read More

ChartWatchers April 07, 2018 at 12:32 PM

Editor's Note: This article was originally published in John Murphy's Market Message on Saturday, April 7th at 7:55am ET Just when it looked like the stock market was about to recover from the first two rounds of tariff threats, stocks were hit with a third and bigger $100 billio... Read More

ChartWatchers April 07, 2018 at 12:18 PM

Earnings season is about to get underway with thousands of companies scheduled to report their Q1 numbers. It's an exciting time each quarter when companies are rewarded or punished depending on their results... Read More

ChartWatchers April 07, 2018 at 11:56 AM

The start of every quarter represents a big opportunity to me and the reason is simple. Historically, the odds favor a bullish move into earnings season... Read More

ChartWatchers April 07, 2018 at 11:24 AM

A wild week for the indexes concluded with a slam on Friday. As we head into earnings, we continue to see the market oscillate between the bulls and the bears. I continue to see a couple of nice things in the wild swings. The upcoming week should tell us which way this is going... Read More

ChartWatchers April 07, 2018 at 06:36 AM

The percentage of stocks above the 50-day EMA is a breadth indicator that measures internal performance. Chartists can compare this indicator across indexes to identify the leaders and laggards... Read More

ChartWatchers April 06, 2018 at 06:07 PM

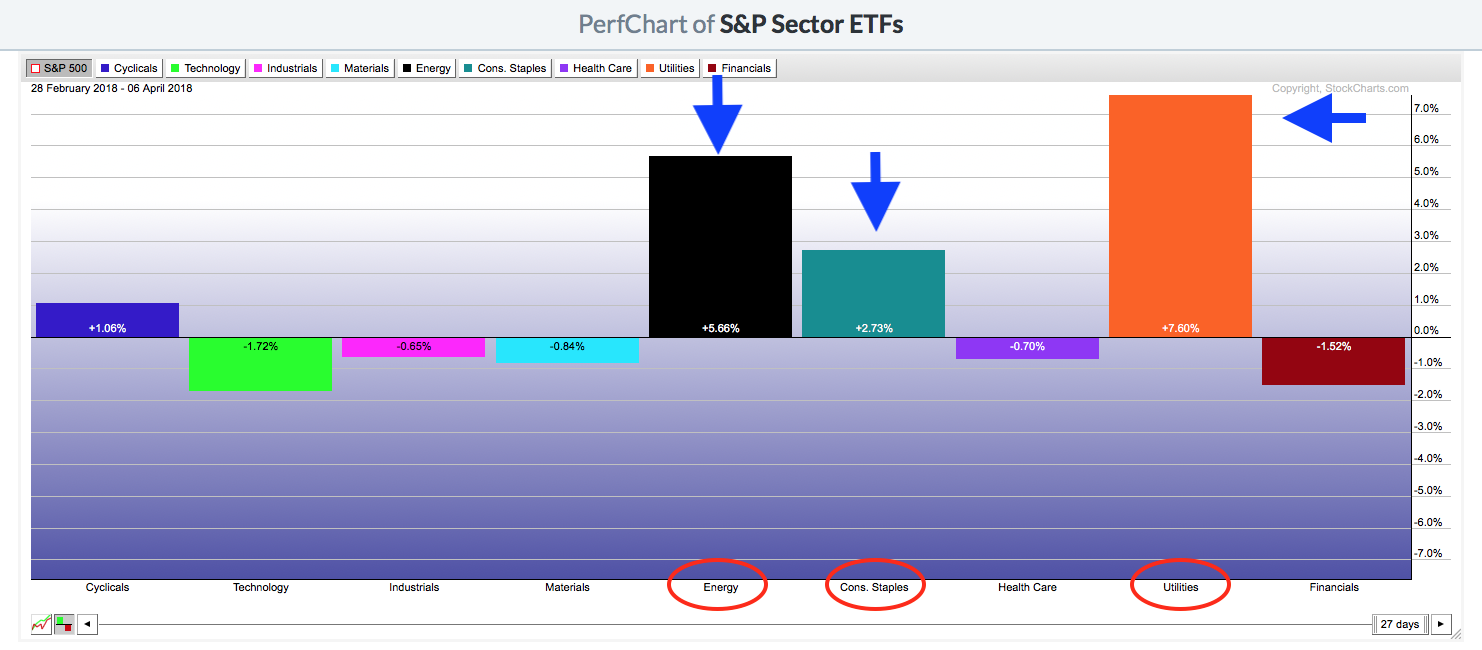

If you've been reading the DecisionPoint Blog lately or watching the MarketWatchers LIVE show on StockCharts TV, you know that I have been expressing concern over the sector rotation over the past few weeks and month... Read More