ChartWatchers March 17, 2018 at 04:37 PM

Editor's Note: This article was originally published in John Murphy's Market Message on Thursday, March 15th at 12:34pm ET The two converging trendlines in the chart below show the Dow Industrials forming a potential "symmetrical triangle" (which has one trendline falling and the... Read More

ChartWatchers March 17, 2018 at 10:30 AM

Regional Banks had a great week. Lots of them are testing big breakout levels and making new highs. Some examples are: Brookline Bancorp: In the small cap SCTR ranking. Independent Bank Corp (IBCP) is starting to move. It is also increasing the dividend consistently... Read More

ChartWatchers March 17, 2018 at 08:56 AM

The NASDAQ Composite and NASDAQ 100 became the first two key indices to break to fresh all-time highs and their 2018 relative strength can be underscored by this chart: The NASDAQ 100 is seeing money rotate its way in 2018 so it's prudent to focus on this index for specific tradi... Read More

ChartWatchers March 17, 2018 at 04:35 AM

The Dow Industrials is in the midst of a narrowing consolidation and chartists should watch the March range for the next directional clue. The 2018 range extends from the January high (26,617) to the February low (23,360), which is 3257 points or around 13% of the current close... Read More

ChartWatchers March 16, 2018 at 07:24 PM

If there's one thing I've learned over my many years trading in the market, it's to avoid chasing a stock, especially if it's overbought. This might seem like an obvious strategy but many traders are drawn to those stocks that are ascending which I can understand... Read More

ChartWatchers March 16, 2018 at 06:00 PM

On Friday's MarketWatchers LIVE program, I did a workshop on volume. Highly recommend you check it out on the StockCharts YouTube Channel or it is available under the webinars tab until Monday's show begins... Read More

ChartWatchers March 03, 2018 at 04:02 PM

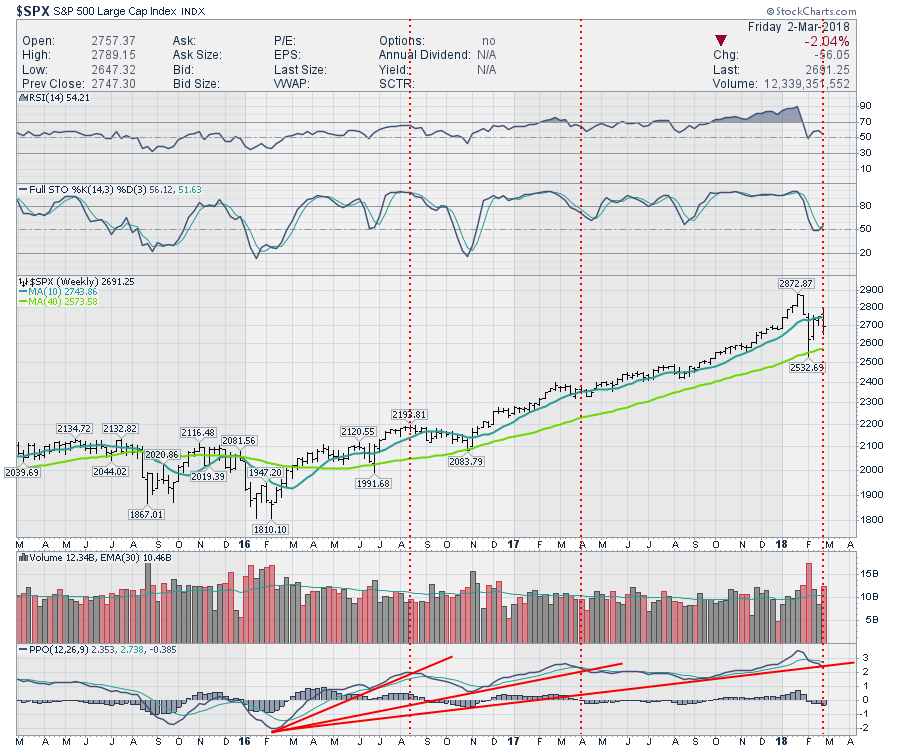

Editor's Note: This article was originally published in John Murphy's Market Message on Friday, March 2nd at 12:26pm ET Wednesday's message showed the PowerShares QQQ (representing the Nasdaq 100 Index) pulling back from overhead resistance at its late January peak... Read More

ChartWatchers March 03, 2018 at 03:04 PM

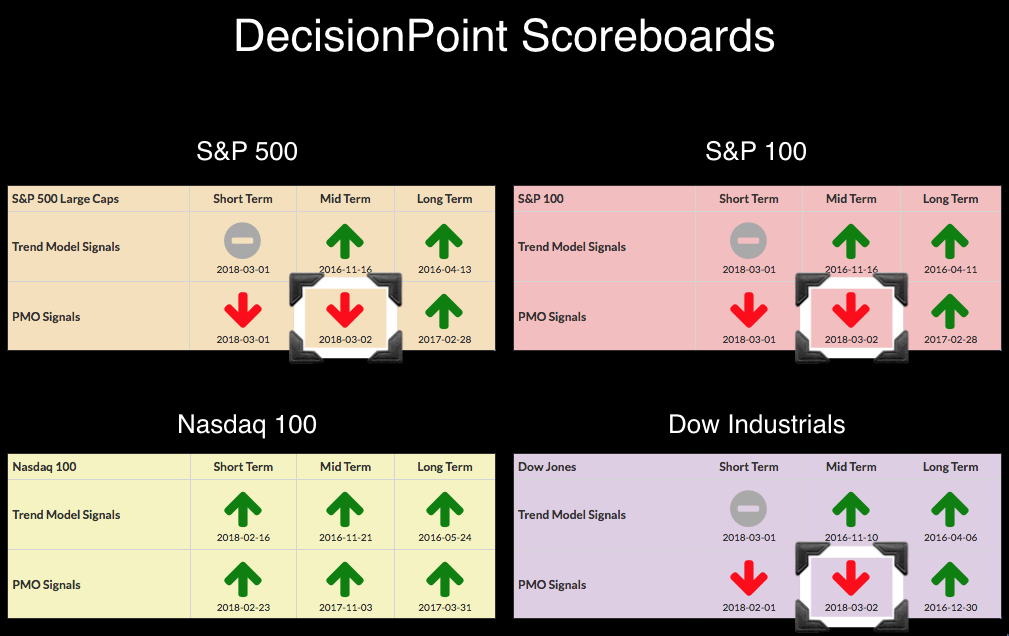

I did a review of the monthly charts Wednesday and noticed a bearish bias. Today three new Intermediate-Term Price Momentum Oscillator (PMO) SELL signals arrived. The weekly PMOs crossed below their signal lines which triggered these signals... Read More

ChartWatchers March 03, 2018 at 02:55 PM

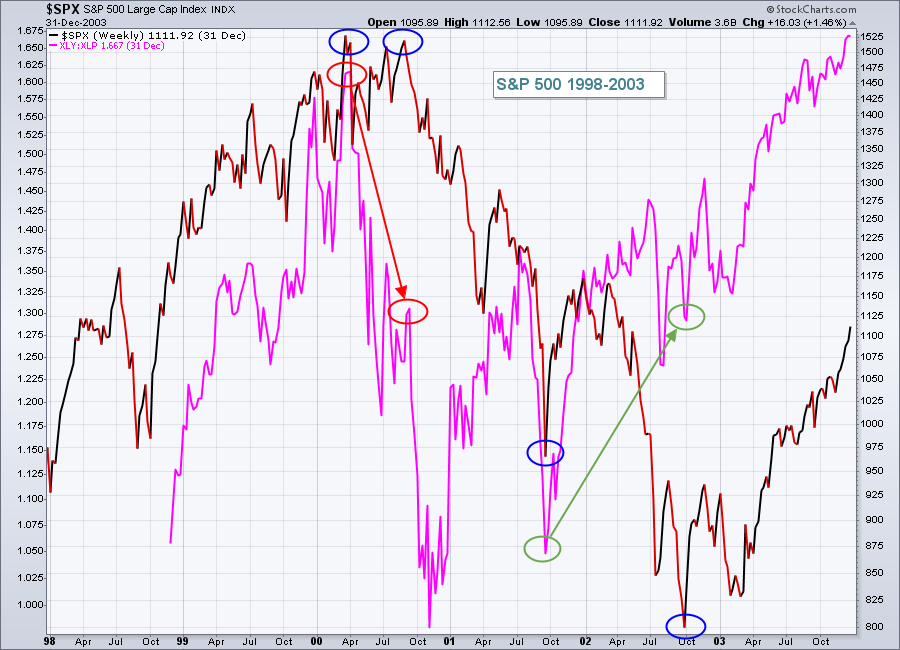

After a massive run in 2017, the market has paused to absorb all the news of the tax package. I am reminded of other instances where the market sold off on good news, surprising retail investors... Read More

ChartWatchers March 03, 2018 at 12:39 PM

THE Question Is this a correction within a bull market or is it the beginning of a bear market? That is THE question that everyone is debating and hoping to answer correctly. There's no crystal ball to know for sure the correct answer... Read More

ChartWatchers March 03, 2018 at 03:14 AM

The principle of confirmation is important to the application of Dow Theory. This principle asserts that the Averages, Dow Industrials and Dow Transports, should confirm each other when making new highs. In other words, both should make new highs to affirm the broad market trend... Read More

ChartWatchers March 02, 2018 at 06:26 PM

Most analysts would agree that overall, 2017 Q4 earnings were superb. For quite a while we saw one company after another beat earnings expectations and they were rewarded for those results as well... Read More