ChartWatchers January 26, 2014 at 12:23 AM

Hello Fellow ChartWatchers! The last two days of last week caused everyone to pause and re-evaluate their market opinions. That includes our stable of ChartWatchers analysts. Glancing over the headlines for their articles below, you'll see lots of use of the "B"-word... "Bearish... Read More

ChartWatchers January 25, 2014 at 11:21 PM

My Wednesday message showed the close correlation between weak emerging market currencies and emerging market stocks. It showed the WisdomTree Emerging Currency Fund (CEW) threatening to break an important support line. The green line in Chart 1 shows that happening... Read More

ChartWatchers January 25, 2014 at 11:16 PM

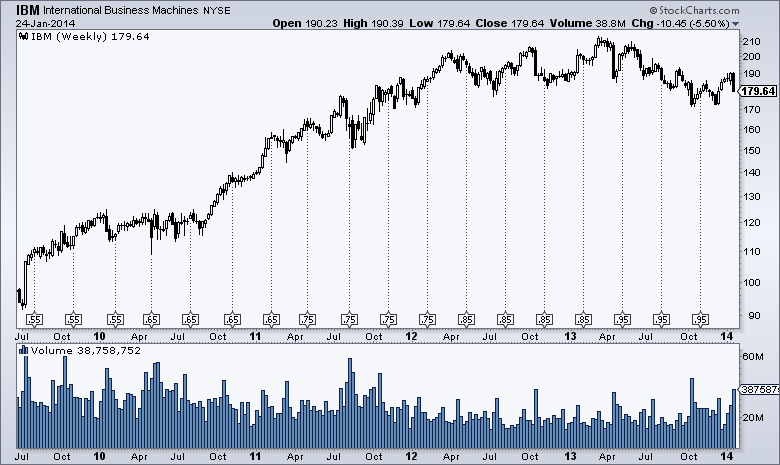

This bull market has been humming along since March 2009, but we cannot ignore the storm clouds building on the horizon... Read More

ChartWatchers January 25, 2014 at 11:14 PM

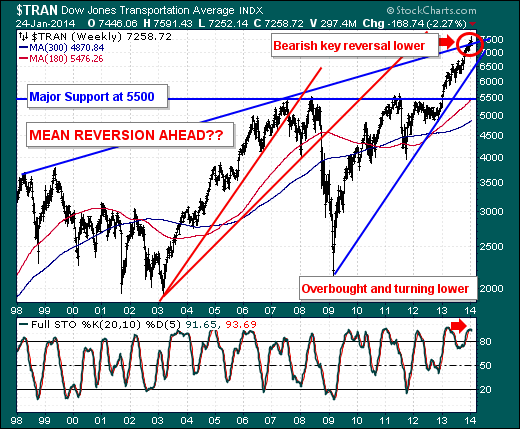

Last week's trade was rather bearish from a technical perspective, for many of the US and world indices forged "bearish weekly key reversals" to the downside. To us, this suggests that a larger correction is underway - perhaps -10%...but perhaps a greater percentage... Read More

ChartWatchers January 25, 2014 at 11:09 PM

The head and shoulders pattern is frequently how a price index puts in a top, and, while it may be a bit early to start talking about it, it is one possible scenario that we can anticipate... Read More

ChartWatchers January 25, 2014 at 02:26 PM

Recently, the IMF Leader - Christine Lagarde - talked about deflation. She announced we must do all we can do prevent deflation from occurring. In Davos, the IMF released their 2014 World Economic Outlook. Look at the trend they predict for commodities... Read More

ChartWatchers January 25, 2014 at 07:58 AM

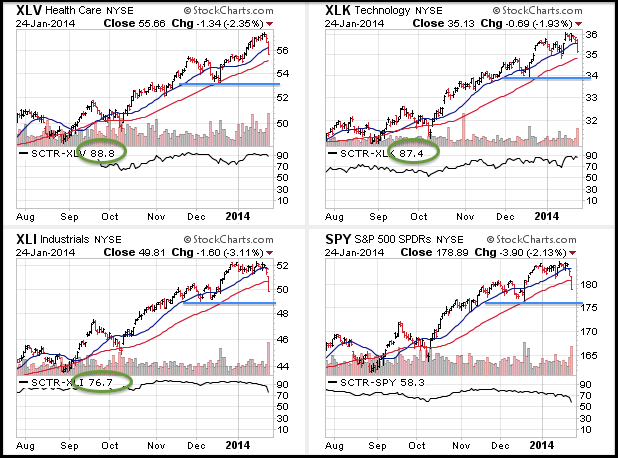

It has been a rough year for stocks and two key offensive sectors are leading the way lower. I like to group the sector SPDRs into three groups: offensive, defensive and other... Read More

ChartWatchers January 12, 2014 at 08:50 PM

Hello Fellow ChartWatchers! Happy New Year! 2013 was very, very good to technical investors. Let's hope 2014 continues that trend. As we mentioned in the previous newsletters, we've put together an amazing line up of speakers for our upcoming ChartCon conference... Read More

ChartWatchers January 12, 2014 at 06:26 PM

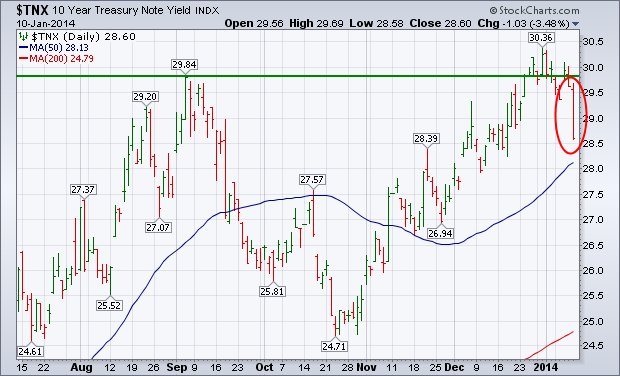

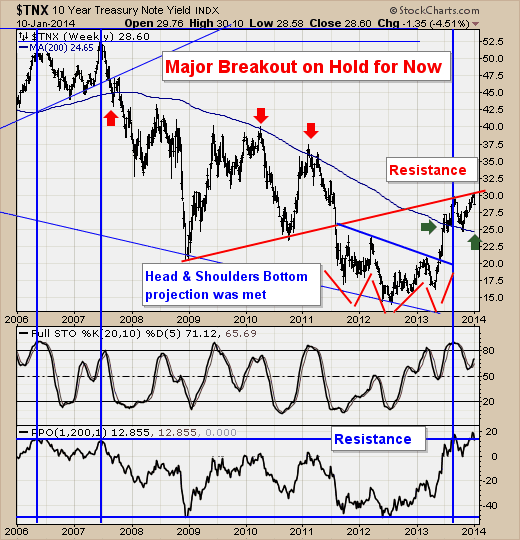

Friday's news that American employers added only 74,000 jobs in December didn't have much of an effect on the broader stock market, but did shock bond investors. Chart 1 shows the 10-Year Treasury Note Yield ($TNX) suffering the worst drop since September... Read More

ChartWatchers January 11, 2014 at 06:58 PM

It's my favorite time of the quarter - as a trader. I approach it like an offensive or defensive coordinator on one of the NFL playoff teams this weekend... Read More

ChartWatchers January 11, 2014 at 06:47 PM

Friday's US Employment Situation Report was much less-than-expected at +87k... Read More

ChartWatchers January 11, 2014 at 02:38 PM

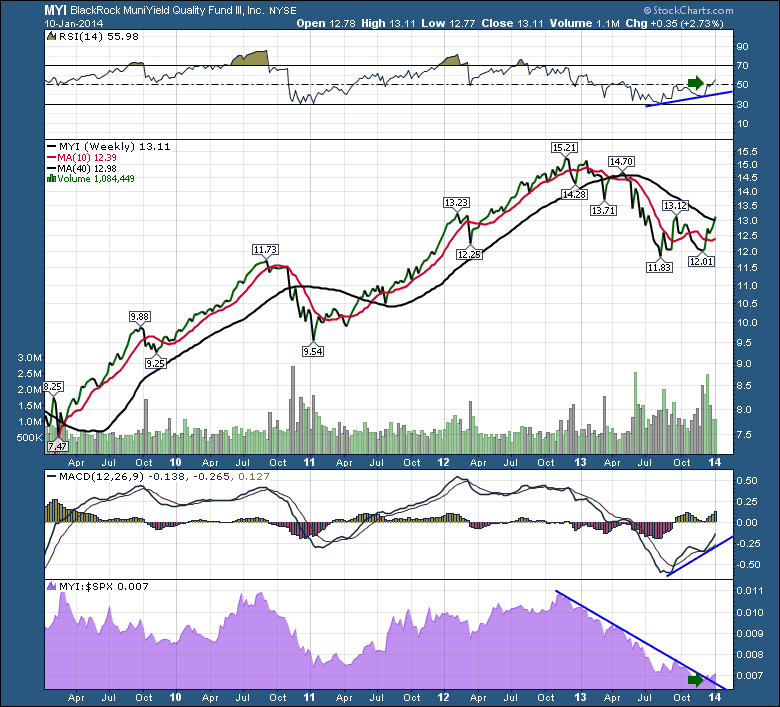

Recently the Municipal Bond ETF started to turn higher. It has been a leading indicator for some of the actual government bond issues. You can see it has broken above the 40 WMA and has started to turn the MA's from down to flat. We'll see if it can extend... Read More

ChartWatchers January 11, 2014 at 09:12 AM

The Dow Diamonds (DIA) and several key stocks within the Dow formed bullish continuation patterns over the last two weeks and traders should watch these patterns for breakouts. DIA formed a falling flag and this pattern represents a rest after a sharp advance... Read More